Get 150+ Ready To Buy Appointments This Week!

Sell More Cars with Expert Car Dealership Marketing

We Provide Car Dealers More Appointments Bigger Grosses More Trade-In's Ready To Buy Automotive Leads More ROI Increased Foot Traffic

Supercharge Your Car Dealership Marketing

Get 150+ weekly showroom appointments with Willowood Ventures' Facebook ads. Our expert team connects your dealership to real car buyers for more sales.

30-50

30-50 Cars Sold via Targeted Strategies

400k

400K Impressions Boosting Dealership Visits

150+

150+ Excited Weekly Appointments

300+

300+ Qualified Leads for Car Dealerships

Elevate Your Car Dealership Marketing with Next-Level Facebook Advertising

Willowood Ventures simplifies car dealership marketing with Facebook ads. We connect you to active car buyers for more visits and faster sales. Watch the video to learn how we generate 300+ automotive sales leads per week!

Start Driving More Buyers to Your Showroom

Discover how Willowood guarantees 150+ new showroom appointments in just 7 days.

-

30-Minute Call! No Sales Pressure

-

Custom Strategy Tailored to Your Dealership

-

Lets Talk About How To Get More Targeted Buyers In Your Showroom

Ignite Car Dealership Marketing Success

🚀 Hyper-Targeted Ads, Expert BDC, Elite Showroom Traffic

We deliver qualified buyers directly to your dealership with data-driven Facebook ads, U.S.-based appointment specialists, and same-day follow-ups to maximize your sales.

Want To Sell More Cars? Let Willowood Ventures Increase Your Appointments Today!

Join 200+ successful U.S. dealerships setting sales records with Willowood Ventures’ proven car dealership marketing using Facebook Sales Events.

Paid Social Media Ads: Helping dealers dominate their markets.

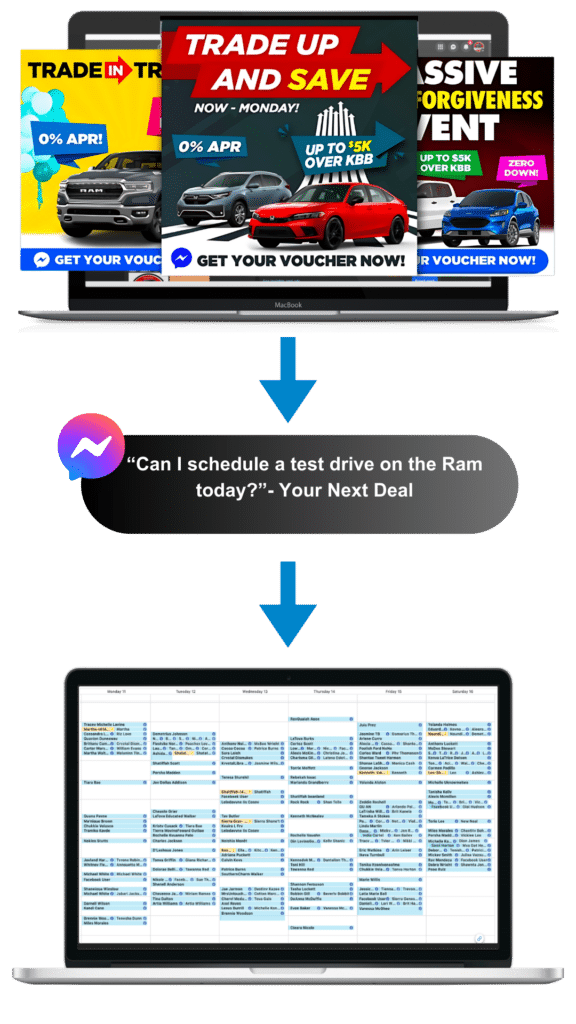

How The Facebook Sales Event Works Three Simple Steps!

- Targeted Car Dealership Marketing: Our Facebook Sales Events use data-driven strategies to deliver customized ads directly to ready-to-buy car shoppers.

- Lead Engagement & Scheduling: Our BDC team schedules and manages leads using proven Facebook Sales Event strategies. We optimize every interaction to maximize your ROI.

- High-Intent Buyers for Car Dealers: Automotive leads from our Facebook Sales Events receive same-day reminders and effective merchandising. We drive ready-to-buy customers straight to your dealership for higher sales conversions.

Why Dealerships Choose Willowood Ventures for Automotive Marketing

Willowood Ventures sets itself apart with over 20 years of real dealership expertise, bringing proven car selling techniques to digital marketing.

- Real car buyers, not just clicks—more qualified leads and higher conversions for your car dealership marketing

- Data-driven car dealership marketing strategies to optimize every campaign for the best return on investment

- Our live U.S.-based BDC team, available 14 hours a day, year-round, supports your car dealership marketing efforts

- Average profit of $3,500+ per car sale—more revenue and less wasted ad spend with car dealership marketing

Get 150+ Guaranteed Appointments with Our Facebook Sales Events

High Engagement & Guaranteed Appointments for Facebook Sales Events

Don’t wait for leads to find you. Our dealers are consitently selling 30-50 additional cars per week with these appointments.

🚀 Get a FREE Car Dealership Marketing Consultation – Limited Time Offer!

We’re offering dealerships a free strategy session to show how our Facebook Sales Events and expert BDC team can generate more leads, appointments, and sales.

💡 Don’t miss out—sign up today and start filling your calendar with serious buyers!

Ready for more showroom traffic? The choice is yours!

SILVER

3-Day Facebook Sales Event

- ✓Targeted FB Ad Spend for Audience

- ✓14-Hour Live BDC Event Support

- ✓Dealer-Branded Event Page

- ✓100k Est. Impressions

- ✓Min. 125 Potential Buyers

- 📅Over 75 Appointments Secured

Multi-Store Discount Available

GOLD

5-Day Facebook Sales Event

- ✓Silver Benefits + Enhancements

- ✓Double Targeted Ad Spend

- ✓BDC Boost: +1 Day Pre-Event

- ✓300k Est. Impressions

- ✓Min. 200+ Hot Auto Leads

- 📅Over 100 Appointments Secured

Multi-Store Discount Available

PLATINUM

7-Day Facebook Sales Event

- ✓Gold Benefits + Premium Features

- ✓Max BDC 24-7 Support

- ✓Instagram Ads for Wider Reach

- ✓400k Est. Impressions

- ✓Min. 300+ Dealer Leads

- 📅Over 150+ Appointments Secured

Multi-Store Discount Available

Facebook Sales Event ROI Calculator

Let's Do Some Math! The ROI Estimate is Based On $3500 A Copy - 50% Appt Close Rate

Facebook Sales Event ROI Analysis

Performance Metrics

Interactive Calculator

Package Details

The Power of Willowood Ventures Car Dealership Marketing

Willowood Ventures uses detailed data including clicks, impressions, CPM and CPC to target active car buyers. Our team creates personalized SMS and social media messages that attract buyers to your dealership.

Try our Interactive ROI Calculator and see your dealership’s potential.

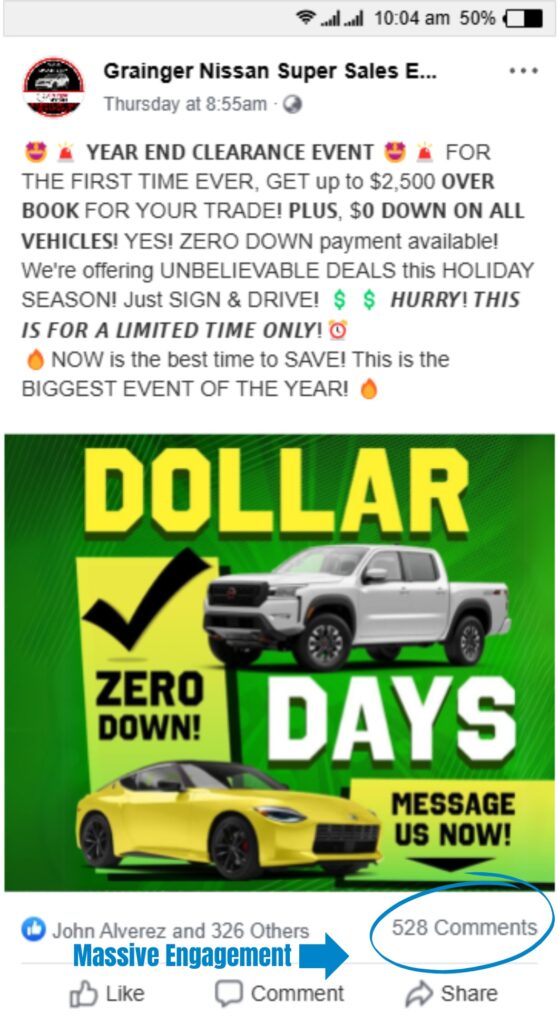

The King of Engagement

Join the fastest-growing digital platform for car dealerships.

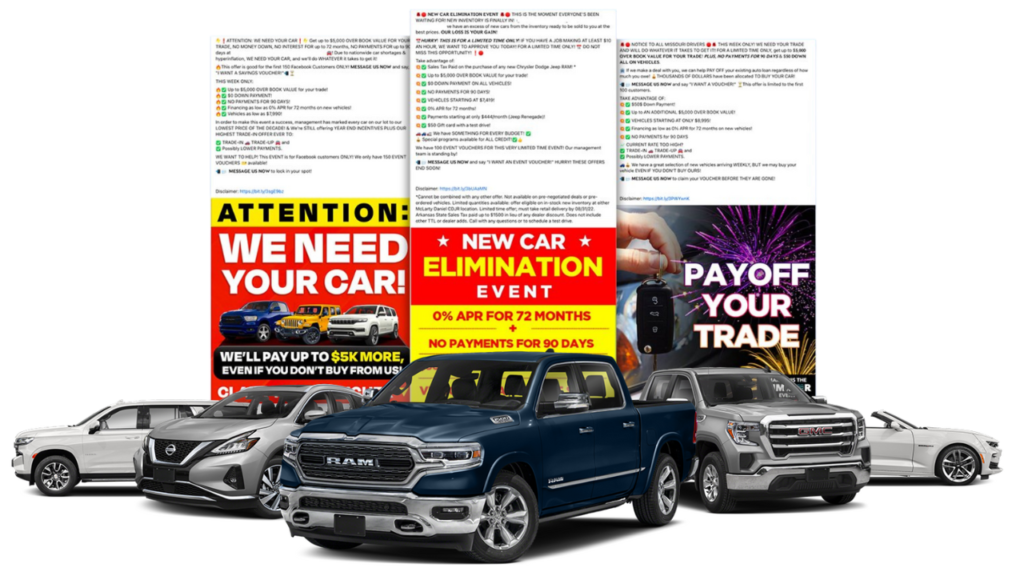

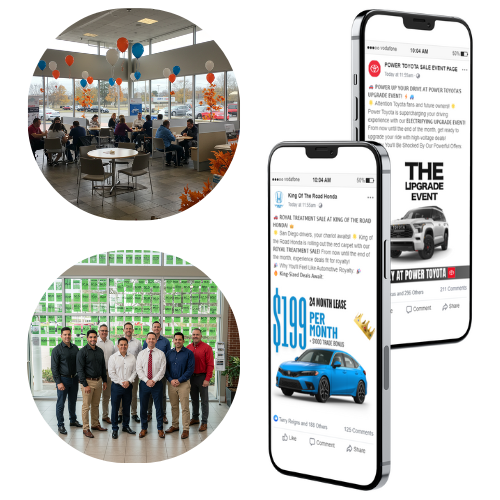

Facebook Ad Examples That Generate Leads & Appointments

Check out creative Facebook ad examples specifically designed to grab in-market buyer attention and convert them into hot leads. See the types of ads Willowood Ventures uses to achieve an average $72.36 cost per appointment for clients. Our dynamic BDC handles the ads and lead conversion; you just sell!

FREQUENTLY ASKED QUESTIONS

Car Dealership Marketing - Facebook Sales Event FAQ

Facebook Sales Events are specialized marketing campaigns that use targeted Facebook and Instagram ads to reach local car buyers and trade-ins. They benefit your dealership by offering:

- Precision targeting by demographics, interests, and purchase intent

- Professional automotive lead generation with our U.S.-based BDC team

- Guaranteed appointments (75, 100, or 150 based on event duration)

- Industry-leading cost of just $72.36 per appointment

- Typically a 60% show rate with high conversion potential

This strategic approach drives more qualified showroom traffic, increases car sales volume, and provides a measurable return on your marketing investment. Our clients consistently see higher engagement than traditional advertising methods.

We offer Guaranteed Single-Store Appointments with a clear structure:

- 3-Day Event: 75 appointments

- 5-Day Event: 100 appointments

- 7-Day Event: 150 appointments

Our process includes rapid campaign setup within 24 hours, full-service management from ad creation to lead conversion, and a live U.S.-based BDC team that qualifies automotive leads in real-time. At an industry-best $72.36 per appointment, we deliver exceptional value. If we don't hit the promised number, we continue working at no extra cost until we do.

Note that walk-ins who see the advertising without submitting a lead are not counted in these guarantees, though they often provide additional sales opportunities.

Willowood Ventures stands apart through:

- Guaranteed automotive dealer leads that no other marketing firm offers

- Industry-leading cost of just $72.36 per appointment

- Proven results across dealerships of all sizes throughout the United States, Canada, and Mexico

- Our North Carolina-based BDC team that qualifies automotive sales leads in real-time (operating 14 hours daily)

- Industry-specific expertise: our CEO, Dominic Scruggs, brings over 20 years of hands-on automotive experience

- Team depth: even our newest members have 5+ years of dealership experience

This automotive industry focus allows us to create more effective Facebook Sales Events tailored specifically to car dealership marketing needs and customer buying behaviors.

As one of the leading automotive lead generation companies, we deliver superior results compared to traditional advertising through our targeted Facebook Sales Events. While traditional methods like radio, TV, and print have declining effectiveness, our digital approach offers:

- Precise targeting based on buying signals and demographics

- Industry-leading $72.36 cost per appointment

- Measurable results with detailed performance tracking

- Guaranteed appointment volume not available with traditional media

- Rapid deployment and flexibility to adjust campaigns in real-time

Most clients run events monthly, with our average 60% show rate and roughly half of those closing, the ROI is quickly evident and outperforms traditional marketing channels that cannot provide such specific performance metrics or guarantees.

Our automotive sales leads services work effectively for virtually all dealership types and inventory mixes. We've delivered successful car dealership marketing campaigns for:

- New car franchises (domestic and import)

- Used car independent dealers

- Luxury brand retailers

- Buy-here-pay-here operations

- Multi-brand auto groups

While new vehicle sales benefit from our targeted approach, we excel particularly with pre-owned inventory and trade-in acquisitions. Our targeting can focus on specific demographics matching your ideal customer profile, whether you're promoting high-line luxury vehicles, affordable family SUVs, or special financing options. Each campaign is customized to showcase your dealership's unique inventory strengths and promotional offers, with an industry-best cost of $72.36 per qualified appointment.

Our automotive lead generation system includes advanced filtering to identify and remove test leads before they reach your sales team. Unlike other automotive lead providers, we have:

- A dedicated U.S.-based BDC team that pre-qualifies every lead through personal phone contact

- Multi-step verification processes to confirm appointment intent

- Behavioral pattern recognition to flag suspicious submissions

- Quality control monitoring that ensures only genuine prospects count toward your guaranteed appointment total

This human verification process eliminates the vast majority of test lead submissions and delivers an industry-leading $72.36 cost per valid appointment, ensuring your sales team only spends time with qualified prospects.

To launch your automotive dealer leads campaign, we need:

- Your dealership name, address, and contact information

- Event dates and duration preference (3-day, 5-day, or 7-day)

- Key selling points or special offers you want to highlight

- Your target market geography (typically 25-50 mile radius)

- Any specific inventory focus (new models, pre-owned, specific vehicle types)

- Basic dealership branding assets (logo, colors)

Our team handles everything else, from ad creation and targeting to lead qualification and appointment setting. We'll provide regular performance updates throughout the campaign and a comprehensive report after completion, showing leads generated, appointments set, show rates, and sales attribution data. Our industry-leading $72.36 cost per appointment delivers exceptional ROI for your car dealership marketing investment.

Willowood Ventures offers the most cost-effective automotive lead generation in the industry with an unprecedented $72.36 per qualified appointment - significantly lower than the industry average. Our pricing structure includes:

- Transparent, all-inclusive pricing based on event duration

- 3-day events with 75 guaranteed appointments

- 5-day events with 100 guaranteed appointments

- 7-day events with 150 guaranteed appointments

- No hidden fees or additional charges

This all-inclusive price covers campaign creation, ad spend, lead qualification through our U.S.-based BDC team, and complete performance reporting. Unlike other automotive lead providers who charge per lead regardless of quality, we only count verified appointments with qualified buyers. If we don't deliver the promised number of appointments, we continue working at no additional cost until we meet our guarantee.

Our specialized approach to generating subprime automotive leads involves custom targeting parameters designed specifically for special finance departments. Our process includes:

- Tailored ad campaigns that speak directly to credit-challenged consumers

- Marketing messaging focused on approval-based language rather than specific vehicle features

- Specialized form fields to pre-qualify leads based on credit situations

- BDC team members trained in handling subprime inquiries with sensitivity

- Custom targeting that reaches consumers actively seeking credit solutions

This targeted approach delivers high-quality special finance opportunities at our industry-leading rate of $72.36 per appointment - providing exceptional value for dealerships with dedicated special finance departments or buy-here-pay-here operations.

Ready to Generate 150+ Appointments for Your Dealership?

Trusted By 200+ Dealers Nationwide

View just a few of our testimonials

O'Fallon Buick GMC

Darric Sewell

Dealer Principal

Grainger Auto Group

Damon Grainger

Dealer Principal

Wright Way Hyundai

Gary Sullivan

Executive Manager

McClinton Chevrolet

Wyn Bowden

General Manager

Ready to Sell More Cars? Request Your Demo! Proven Marketing Strategies that Fill Your Showroom in 24 Hours !

Limited Spots Available—Request Your Demo Now!

Start Driving More Buyers to Your Showroom!

Your info is secure. No spam, no obligation.

By submitting this form, you agree to be contacted by Willowood Ventures via phone, email, and SMS for the purpose of responding to your inquiry and providing information about our services. Standard message and data rates may apply. You may opt out at any time by replying STOP to SMS messages or by contacting us directly.